do you need to pay taxes when you sell a car

You would not have to report this to the IRS. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax.

When I Sell My Car Do I Have To Pay Taxes Carvio

When you sell a car for more than it is worth you do have to pay taxes.

. The Department of Revenue. How to Sell a Car in Colorado Step 1. However if you bought it for.

You must collect all applicable taxes and you should generally collect the sales tax rate that applies at the location of the sale. So if you bought the car for 14000 and sold it for 8000 you would have a capitol loss of 6000. Youll report it on Schedule D of Form 1040 on.

Selling a car for more than you have invested in it is considered a capital gain. If a car had been owned. This reseller permit is used to purchase vehicles for resale without having to pay the sales tax or use tax as long as you do not title the vehicle in your name.

You also have to factor the improvements into the equation. So youll owe no tax. However you wont need to pay the tax.

Chances are that the car youre selling was one you drove on a daily basis for commuting and work purposes. Thus you have to pay. You dont have to pay any taxes when you sell a private car.

No need to worry. The good news is that you dont need to pay capital gains tax on the difference between the purchase price and the sale price. How do I sell my personal car in Colorado.

If the payments are spread out over a long period you can reduce. Allow the Buyer to Have the Vehicle Inspected by a Third Party. Clean Out the Vehicle.

In most cases you do not have to pay any taxes when you sell your car to a private seller or a company like The Car Depot. So if your used vehicle costs 20000 and you live in a state that charges a 6 sales tax the sales tax will raise your cars purchase price to 21200 excluding any additional. According to finance experts the answer is no in most cases.

A capital gains tax is due on the sale if the sale price for the car is more than the adjusted basis of the car for the person who made the gift of the car. This will depend on the state. Fortunately most drivers dont have to worry about paying extra taxes.

However you do not pay that tax to the car dealer or individual selling the. Most car sales involve a vehicle that you. Even in the unlikely event that you sell your private car for more than you paid for it special HM Revenue and Customs rules mean.

Do I Have to Pay. But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit. The state charges a 7 sales tax on the total car price at the.

Critically with an installment sale you only have to pay income taxes on the amount the buyer pays you in a given year. For example if you purchased a used car from a family member for 1000 and later sold it for 4000 you will need to pay taxes on the profit. If you sold the car for more than the total cost calculated in steps 1-3 then youll owe tax on that amount.

When you buy a car you have to pay Indiana sales tax on the purchase plus excise tax to register the vehicle. The answer to this question is no you do not have to pay taxes on the sale of your vehicle unless of course you actually sell your car for more than what its worth or more than. In most cases when you buy a car it depreciates in value as soon as you leave the car lot.

Ved Road Tax How Does Car Tax Work And How Much Will It Cost Auto Express

Cryptocurrency Taxes A Guide To Tax Rules For Bitcoin Ethereum And More Bankrate

Understanding Taxes When Buying And Selling A Car Cargurus

Do You Have To Pay Taxes When You Sell Your House

Understanding Taxes When Buying And Selling A Car Cargurus

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

How To Register Vehicles Purchased In Private Sales California Dmv

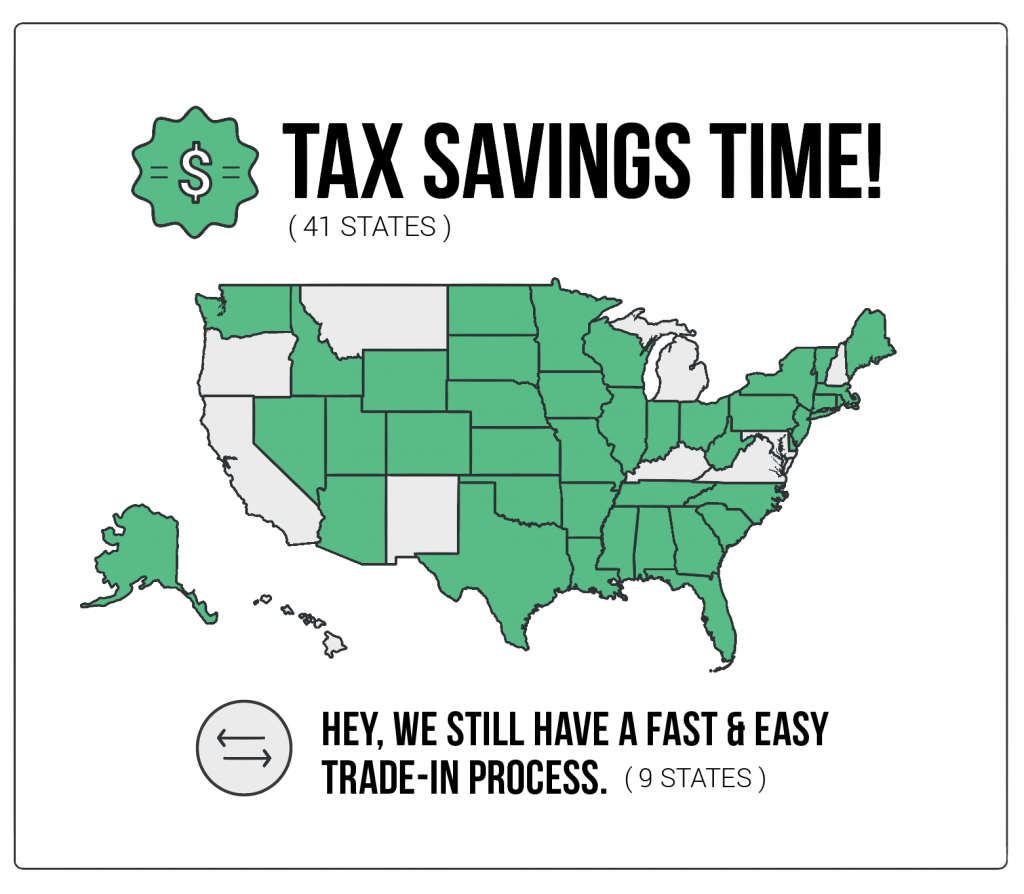

Buying A New Car Use A Trade In To Get A Sweet Tax Credit In These 41 States By Vroom Vroom

Tax When You Sell A Classic Car In The Uk Taxscouts

/NowMayBeaGoodTimetoTradeInYourCar-2b64f10ea31b497fb0d82b8cc9e6fedc.jpg)

How Does Trading In A Car Work

Important Tax Information For Used Vehicle Dealers California Dmv

Do You Pay Taxes On Investments What You Need To Know Turbotax Tax Tips Videos

Your Tax Law Questions About Collector Cars Answered

Does The Seller Have To Pay Tax On A Vehicle When He Sells It

Selling To A Dealer Taxes And Other Considerations News Cars Com

Nj Car Sales Tax Everything You Need To Know

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds

:max_bytes(150000):strip_icc()/car-repair-following-insurance-claim-accident-527113_color-e5cd60eaed274db5b5e65c860183cd64.png)